Hi Friend,

Today, we’re diving into the world of payroll streamlining. If you’re among those still handling paychecks without the aid of an accounting system, you’re not alone – many businesses are in the same boat. What’s surprising is the transformation that occurs when you finally make the switch to a newer payroll system. Whether you’re currently using manual methods or outdated software, the benefits of transitioning to a modern payroll system are truly remarkable.

- Introduction:

- Understanding the Current Landscape of Payroll Processing

- Benefits of Streamlining Payroll Processes

- Exploring Streamlining Options

- Comparing Options

- Key Features of Modern Payroll Solutions

- Implementing Efficient Processes

- Conclusion:

Introduction:

Picture this: It’s Monday morning, and you’re settling into your office with a steaming cup of coffee, ready to tackle the week ahead. But before you can even take a sip, the dreaded task of payroll looms over you like a dark cloud. Hours spent crunching numbers, wrestling with spreadsheets, and deciphering time sheets—it’s enough to make even the most seasoned entrepreneur break out in a cold sweat. But fear not, dear reader, for you are not alone in this struggle.

In today’s fast-paced business world, efficient payroll processes are the lifeblood of small businesses everywhere. From ensuring employees are paid accurately and on time to staying compliant with ever-changing tax regulations, the stakes couldn’t be higher. After all, a smoothly functioning payroll system isn’t just a nice-to-have—it’s essential for the success and sustainability of your business. So, buckle up as we dive into the future of payroll and discover how streamlining processes can pave the way for success.

Understanding the Current Landscape of Payroll Processing

In today’s digital age, the way we handle payroll has evolved significantly. However, many small businesses still find themselves stuck in the quagmire of outdated payroll methods. Let’s take a closer look at the three main approaches to payroll processing and their respective challenges.

Manual Payroll Processing:

Traditionally, payroll was a labour-intensive process, with calculations performed manually and records kept by hand. Not only is this method time-consuming, but it’s also highly susceptible to human error. From incorrect calculations to misplaced decimal points, the margin for error is alarmingly high, leading to headaches and frustration for small business owners.

Spreadsheet-based Systems:

While spreadsheets offer a semblance of organization, they come with their own set of drawbacks. As a business grows, so too does the complexity of its payroll. Yet, spreadsheet-based systems struggle to keep pace, often buckling under the weight of increasing data volume. Moreover, the risk of data loss looms large, with one accidental keystroke capable of wreaking havoc on an entire payroll spreadsheet.

Software Solutions:

Enter payroll software—the modern-day saviour of small businesses seeking efficiency and accuracy. With a wide array of options available, from cloud-based platforms to desktop applications, choosing the right software can be daunting. Factors such as effectiveness, ease of use, and cost-effectiveness must be carefully considered to ensure a seamless transition to digital payroll processing.

As small business owners, operators, and administrators, it’s crucial to recognize the limitations of traditional payroll methods and the potential for improvement offered by modern solutions. By identifying pain points in our current payroll processes, we can pave the way for a smoother, more efficient future.

Benefits of Streamlining Payroll Processes

In the ever-evolving landscape of small business management, efficiency is the name of the game. By streamlining your payroll processes, you stand to reap a multitude of benefits that can propel your business towards success.

Time and Cost Savings:

One of the most significant advantages of adopting streamlined payroll solutions is the automation of repetitive tasks. With payroll software handling calculations, tax deductions, and employee payments, you’ll free up valuable time that can be reinvested into growing your business. No longer will you find yourself bogged down by manual data entry or wrestling with complex spreadsheets. Instead, you’ll enjoy the convenience of streamlined processes that allow you to focus on what truly matters—running and expanding your business.

But the benefits don’t stop there. By reducing the time spent on payroll administration, you’ll also realize cost savings in the long run. With fewer hours dedicated to payroll processing, you’ll save on labour costs and increase overall productivity. It’s a win-win situation for your bottom line and your business’s growth trajectory.

Accuracy and Compliance:

In addition to time and cost savings, streamlined payroll processes offer the invaluable gift of accuracy and compliance. Gone are the days of fretting over miscalculations or worrying about regulatory missteps. With payroll software handling the heavy lifting, you can rest assured that your payroll is accurate and compliant with ever-changing tax laws and regulations.

By minimizing errors and ensuring regulatory compliance, streamlined payroll processes provide peace of mind for small business owners, operators, and administrators. No more sleepless nights spent worrying about payroll mistakes or facing penalties for non-compliance. Instead, you can focus your energy on driving your business forward with confidence, knowing that your payroll processes are efficient, accurate, and compliant.

Exploring Streamlining Options

In our quest to streamline payroll processes for small business success, we are presented with a plethora of options and tools at our disposal. Let’s delve into three key strategies for streamlining payroll and their respective benefits.

Payroll Software:

At the forefront of payroll streamlining solutions is the advent of payroll software. These automated systems offer a host of advantages, including accuracy, efficiency, and scalability. By automating calculations, tax deductions, and payment processing, payroll software eliminates the need for manual data entry and reduces the risk of human error. Moreover, many payroll software solutions come equipped with user-friendly interfaces and customizable features, making them suitable for businesses of all sizes and industries. From basic payroll processing to more advanced HR functionalities, payroll software offers a comprehensive solution for streamlining payroll processes.

Outsourcing Payroll:

For small businesses looking to offload the burden of payroll processing entirely, outsourcing payroll to a third-party service provider is an attractive option. Outsourcing payroll offers a range of benefits, including cost savings, compliance assurance, and access to expert knowledge and resources. By entrusting payroll responsibilities to experienced professionals, small business owners can focus their time and energy on core business activities, rather than getting bogged down by administrative tasks. Additionally, outsourcing payroll can provide peace of mind, knowing that payroll processes are being handled by professionals who are well-versed in the latest tax laws and regulations.

Integrations:

In today’s interconnected business environment, integrating payroll with other business systems is essential for maximizing efficiency and productivity. Whether it’s syncing payroll data with accounting software, time tracking systems, or employee management platforms, integrations streamline workflows and reduce duplicate data entry. When considering payroll integrations, it’s essential to evaluate compatibility, ease of implementation, and the potential for automation. By seamlessly integrating payroll with other business systems, small businesses can eliminate silos, improve data accuracy, and gain valuable insights into their operations.

Exploring streamlining options for payroll processes is crucial for small business success. Whether it’s leveraging payroll software, outsourcing payroll responsibilities, or integrating payroll with other business systems, each option offers unique advantages tailored to different business needs. By carefully evaluating these options and choosing the right solution for your business, you can streamline payroll processes, improve efficiency, and position your business for long-term success.

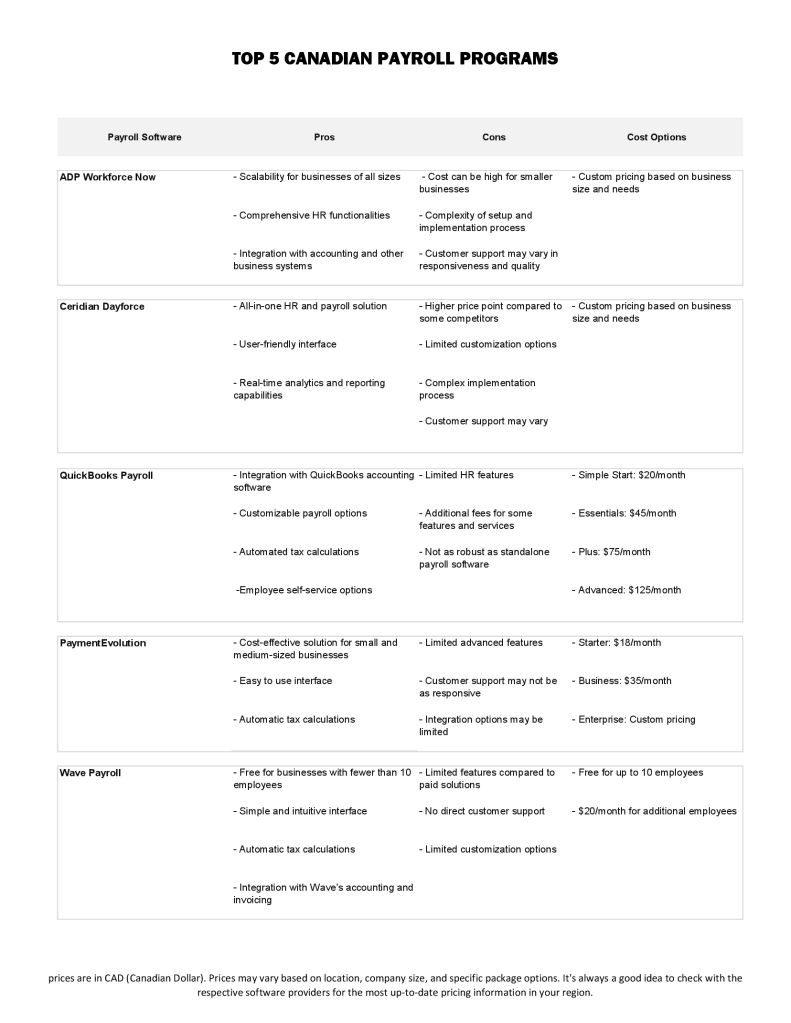

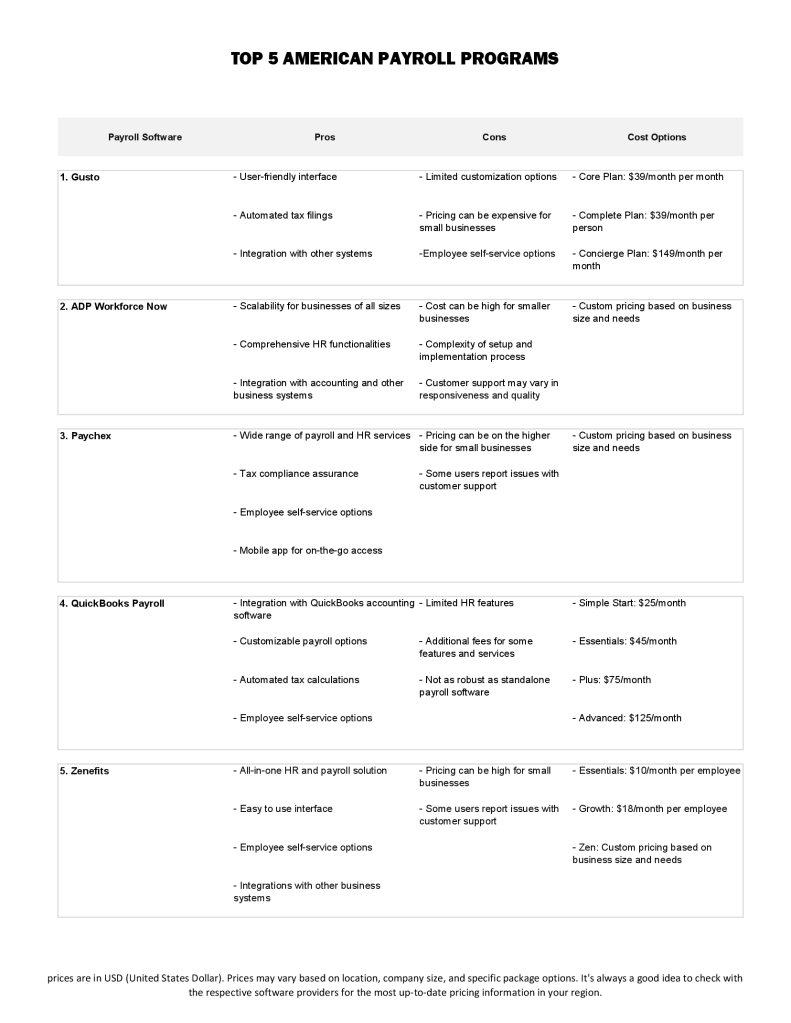

Comparing Options

Key Features of Modern Payroll Solutions

In our journey towards streamlining payroll processes, it’s essential to understand the key features and functionalities offered by modern payroll software. Two crucial aspects that define these innovative solutions are Automated Calculations and Integration with Other Systems.

Automated Calculations:

At the heart of modern payroll software lies the power of automation. These advanced systems are equipped to handle complex calculations with ease, from calculating taxes and deductions to processing employee payments. By automating these calculations, payroll software eliminates the risk of errors and ensures accuracy in every paycheck. Moreover, with built-in compliance features, payroll software keeps pace with ever-changing tax laws and regulations, helping small businesses stay compliant and avoid costly penalties.

Integration with Other Systems:

Another key feature of modern payroll solutions is their seamless integration with other business systems. Whether it’s syncing payroll data with accounting software, HR platforms, or time tracking systems, integration streamlines workflows and eliminates the need for manual data entry. By syncing payroll data across different systems, small businesses can improve efficiency, reduce errors, and gain valuable insights into their operations. Moreover, integration allows for real-time updates and ensures data consistency across all business processes, enabling better decision-making and strategic planning.

Modern payroll solutions offer a range of features and functionalities designed to streamline payroll processes and enhance efficiency for small businesses. From automated calculations to seamless integration with other systems, these innovative solutions empower small business owners, operators, and administrators to take control of their payroll operations and position their businesses for success in the future.

Implementing Efficient Processes

As we embark on the journey to streamline payroll processes for success, it’s essential to navigate the implementation phase with care and diligence. Let’s explore the key steps involved in transitioning to streamlined payroll processes.

Training and Education:

First and foremost, it’s crucial to ensure that your staff are familiar with the new payroll systems. Provide comprehensive training sessions to familiarize employees with the features and functionalities of the software. Encourage active participation and address any questions or concerns that may arise. By investing in training and education, you empower your team to leverage the full potential of the new payroll systems and minimize disruptions during the transition period.

Data Migration:

Next, it’s time to transfer existing payroll data to the new systems accurately. This process requires careful planning and attention to detail to ensure data integrity and consistency. Work closely with your IT team or payroll service provider to develop a migration strategy that minimizes downtime and mitigates the risk of data loss. Conduct thorough testing to verify the accuracy of the migrated data and address any discrepancies promptly.

Testing and Troubleshooting:

Before fully implementing the streamlined payroll processes, it’s essential to conduct rigorous testing and troubleshooting. Identify potential issues or challenges that may arise during the transition and develop contingency plans to address them effectively. Test the new payroll systems in a controlled environment to simulate real-world scenarios and ensure functionality across all business processes. Address any issues or concerns promptly to minimize disruptions and maintain productivity.

Implementing efficient payroll processes requires careful planning, training, and testing. By ensuring staff are familiar with the new systems, accurately migrating data, and conducting thorough testing and troubleshooting, small businesses can achieve a smooth transition to streamlined payroll processes. Offer practical advice and support to your team throughout the implementation phase to maximize success and position your business for future growth and success.

Conclusion:

In conclusion, our exploration of the future of payroll and the importance of streamlining processes for small business success has shed light on several key insights. We began by understanding the current landscape of payroll processing, recognizing the limitations of traditional methods and the need for innovation. Next, we delved into the myriad benefits of streamlining payroll processes, from time and cost savings to accuracy and compliance.

We then explored various streamlining options available to small businesses, including payroll software, outsourcing, and integrations with other business systems. By considering these options, small business owners, operators, and administrators can find the solution that best fits their unique needs and objectives.

Moreover, we examined the key features of modern payroll solutions, highlighting the automation of calculations and seamless integration with other systems. These features empower small businesses to streamline payroll processes and enhance efficiency in their operations.

Finally, we discussed the importance of implementing efficient processes when transitioning to streamlined payroll solutions. By investing in training and education, accurately migrating data, and conducting thorough testing and troubleshooting, small businesses can achieve a smooth transition and reap the benefits of streamlined payroll processes.

In closing, we emphasize the critical role that streamlining payroll processes plays in small business success. We encourage readers to take action and explore options for improving their payroll operations, inspiring confidence in the benefits of adopting streamlined payroll solutions. By embracing innovation and efficiency, small businesses can pave the way for a brighter future and achieve their goals with confidence

Be the first to know when the next post drops!

Enter your name and email address below to subscribe to our weekly newsletter!

Discover more from Administrator Aid

Subscribe to get the latest posts sent to your email.